Posted under: RCA

On September 28th, the National Hockey League crowned its new champions of the Stanley Cup. For fans, players, and team members, this represents the Holy Grail for the sport. Apart from the thrilling end to the playoffs, this game marks the end of the season and the start of a new one, filled with more uncertainty than we have seen in the modern era.

With the Covid-19 pandemic, even the holiest of sports in Canada was disrupted, shaking the business plan and salary caps into uncharted waters. As a result, a far different offseason is expected as it pertains to free agents, trades, and roster makeup when dealing with potentially a flat salary cap.

According to the RAM Financial Group, the average career length of an NHL Player is 5.5 years, so it is crucial to explore every avenue available to them to protect their savings. Proper tax planning in order to fund the next chapter of their lives should be a key consideration. We have seen tax rates in Canada increase substantially in the majority of provinces since 2015, and with the pandemic and increased Government spending to stave off a financial crisis, it becomes clear that taxes in the near term are more likely to increase than decrease.

What if there was a way for the player to tax shelter income during their years playing in the NHL while spreading out that tax liability over their post-career years, at a time when their taxable income is often significantly lower?

Retirement Compensation Arrangements (RCAs) are one of the tools that can be used to facilitate a deferral. Defined in section 248(1) of the Canadian Income Tax Act, the RCA is a supplemental retirement plan that can be used to set aside earnings for retirement. Within the Act, there are certain provisions for artists and athletes to fund the RCA directly through their payroll without the same concerns of a Salary Deferral Arrangement (SDA) as we would see with a typical salaried employee.

Unlike other types of registered plans in Canada, RCAs allow for funding room that is based on the average of the player’s best three years of earnings, with no earnings maximum as we would see with RSPs or the Player’s NHLPA pension. Before the start of each season, the player can elect how much of their salary is to be set aside for RCA contributions and this would be built into the team’s payroll. If in a particular league year the player would like to not contribute or contribute a larger amount, there is flexibility to do so.

How does the RCA work?

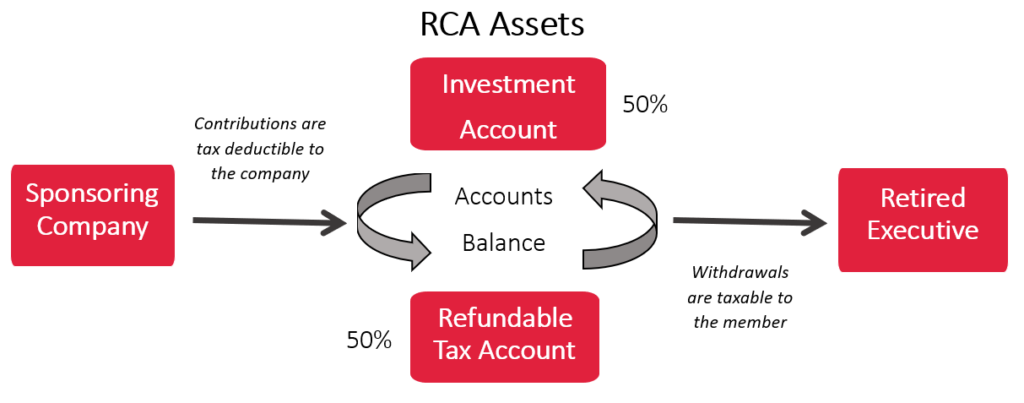

Contributions to the RCA are made on a payroll basis with the team where at each pay period, 50% of the desired amount is contributed to an Investment Account (RCA Trust) and 50% is remitted to a non-interest bearing account with CRA called a Refundable Tax Account (RTA). Any realized investment returns are also subject to 50% refundable tax. CRA will hold 50% of these assets in a Refundable Tax Account (RTA). These funds are still assets of the RCA trust, but do not earn interest. On retirement, as funds are withdrawn from the RCA, the trust is reimbursed from the RTA so the two accounts remain balanced. All funds paid from the RCA are subject to actual income tax rates in the year received.

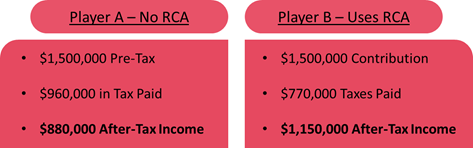

Consider an example of a 28-year-old player on an Ontario team who is averaging $3,500,000 in income per year and is in the second last year of a five year contract. From a cash flow perspective, the player can set aside $1,500,000 from his current year’s salary. We will assume the top tax rate of 53.53% on the salary, a 5% rate of return on any investible assets and withdrawals of $150,000 from age 35 to age 45 at a 40% tax rate.

By utilizing the RCA strategy and smoothing out the income, the Player ends up with $270,000 more in after tax savings in this example. Contact GBL to learn about RCAs for NHL players.

By Fraser Lang CLU, CFP, CHS, Senior Vice President, GBL Inc.

Founded in 1995, GBL is a leading provider of retirement and health solutions for business owners across Canada. For more information on our services and strategies contact: [email protected] or 403.249.1820 and follow us to learn how we can help Build Your Future.