Posted under: Business Owners, RCA, FMV

For the majority of small business owners, selling the shares of their corporation is often seen as the pot of gold at the end of the rainbow. There is an expectation that the lifetime capital gains exemption (LGCE) will be able to be used by the shareholders to greatly reduce the taxes from the sale. Great care needs to be taken so that there are no unforeseen hurdles that may impact the sale or impede the access to the LCGE.

Corporately Owned Life Insurance

One area that often gets overlooked in the transaction is the ownership of any life insurance within the OpCo and the misconception that the policy is transferred either to a HoldCo or personally at the cash value. For CRA purposes, the transfer should be transacted at the Fair Market Value (FMV), and an Actuary is required to provide this value.

The below chart outlines the situations where an FMV is required:

| Transaction | FMV Required? |

| Personally owned to corporately owned | No. Policy can be transferred at cash surrender value, or FMV |

| Corporately owned to personally owned | Yes. An FMV is required on the policy by CRA |

| Transfer from one corporation to another | If the corporation of which the policy is transferred to is unrelated, then an FMV is required. If the corporation is related, then an FMV is not required, but recommended. |

Another planning strategy is to donate the corporately owned life insurance policy to a registered charity. The benefit of completing an FMV before doing so is that the tax receipt the donor receives could potentially be significantly higher. GBL can complete initial estimates prior to the transfer or donation of a policy in order to give you an opportunity to plan for the best possible outcome.

Identifying early on in the transaction that life insurance is owned within the OpCo can save a last-minute scramble to have the policy transferred and valued, and avoid any delays in closing the transaction.

Retirement Compensation Arrangement (RCA)

The RCA is a Retirement Trust that allows for large sums of money to be deposited into it, while providing the plan member flexibility over withdrawals which can significantly reduce their tax paid on money drawn from the RCA. In addition to the personal tax benefits, the corporation also receives a deduction for every dollar that is deposited into the RCA. The RCA is particularly useful in a share sale.

In cases of a share sale, it is critical to ensure the corporation is eligible for the Lifetime Capital Gains Exemption (LCGE). An abundance of passive income can put the company offside and as a result negate the biggest feature of a share sale. Some measures such as use of the capital dividend account (CDA) or paying back shareholder loans may be used to extract these passive assets, but another effective method is the use of the RCA.

In cases where the business owner has passive assets at the time of sale, has used up the $500,000 available in the CDA, and is over the limit of the 90/10 rule, the RCA can be leveraged to potentially absorb up to the full amount that is over the 90/10 rule and extract excess capital from the corporation.

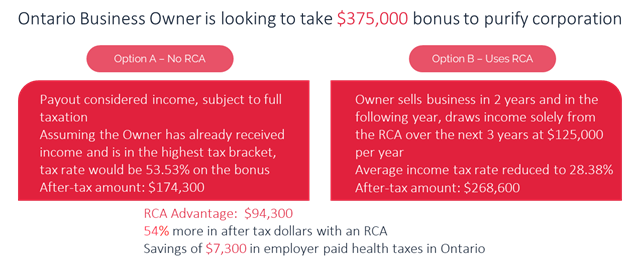

A general example would follow an Ontario business owner in the 53.53% marginal tax bracket who plans to sell the shares of their business in two years. Passive income is offside by $375k, which impedes access to the LCGE, and the business owner is already bonusing to get below the $500k small business deduction limit by $250k:

The RCA can also be used if there are key employees that the owner wishes to provide a retirement benefit or incentivize to remain with the company post sale of the business.

The team at GBL can work with you, your Financial Advisor, and/or Accountant to understand your needs and custom tailor the best strategy or strategies to provide you additional value in the sale of your business. Reach out to your GBL representative to discuss how these powerful planning strategies can complement your sale plan.