Posted under: RCA

Taxes are said to be one of the things that are certain in life, and professional hockey players sure do pay a lot of them. As we Canadians reel from the pain of another year of the cup not coming back home, we tip our hats to the tenacious spirit of the Edmonton Oilers. The crowning of the Florida Panthers as the 2024 Stanley Cup Champions signals the start of an off-season where players will have the opportunity to review their financial plans with their advisors. A key consideration should be how athletes can keep more of their earnings so that they can better fund a lengthy retirement period.

The challenges faced by NHL players are unique and sizeable. For example:

What is a Retirement Compensation Arrangement (RCA)?

An RCA is a retirement plan permitted by the Canada Revenue Agency (CRA), which can be used to set aside earnings for retirement on a tax deferred basis. Similar to an RRSP, income tax is not paid on income deposited into an RCA, and taxes are only payable on the withdrawals once they commence in retirement. Whilst the money remains in the RCA, it can be invested. Unlike an RRSP, the contribution room generated in an RCA can be significantly large and often reaches into the millions.

Within the Canadian Income Tax Act (Act), there are provisions that allow professional athletes to fund an RCA directly through their payroll. Consequently, an NHL player can direct a portion of their salary to an RCA on a tax deferred basis and invest the money within the RCA. In the retirement years, the athlete can withdraw the RCA funds over a period of time when they may be in a lower tax bracket or live in a jurisdiction with lower personal income tax rates. An illustrated example of this strategy is included below.

How does the RCA work?

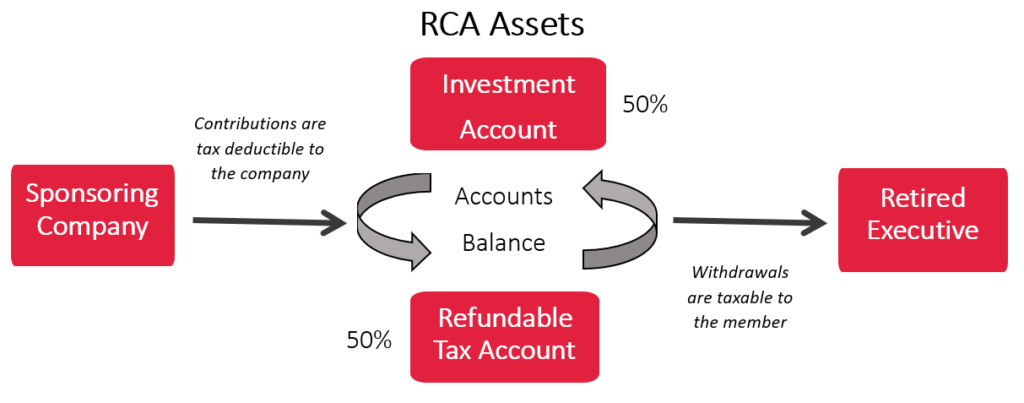

The RCA is setup by the NHL player’s employer (“the club”) as a trust for the benefit of the employee (“the player”) to supplement future retirement needs. Once application for an RCA is filed with the CRA, a Refundable Tax Account (RTA) is established for the RCA. The diagram below illustrates the structure of the RCA.

Contributions to the RCA are made on a payroll basis with the club where at each pay period, 50% of the desired amount is contributed to an Investment Account (RCA Trust) and 50% is remitted to a non-interest-bearing account with CRA called a Refundable Tax Account (RTA). Any realized investment returns are also subject to 50% refundable tax. CRA will hold 50% of these assets in the RTA. These funds are still assets of the RCA trust, but do not earn interest. On retirement, as funds are withdrawn from the RCA, the trust is reimbursed from the RTA so the two accounts remain balanced. All funds paid from the RCA are subject to income tax rates in the year received. Whilst only 50% of the RCA assets are invested in the Investment Account, the gain in after-tax income can often offset this perceived loss. See the RCA Example below for an illustration.

An RCA Example [1]

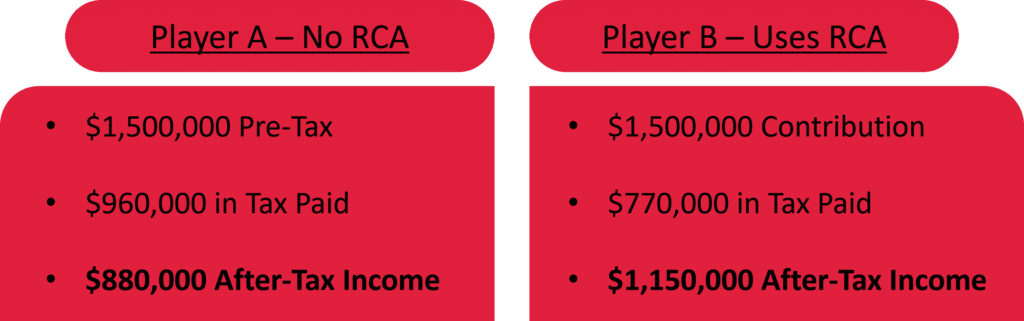

Consider an example of a 28-year-old player on an Ontario team who is averaging $3,500,000 in income per year and is in the second last year of a five-year contract. From a cash flow perspective, the player can set aside $1,500,000 from his current year’s salary. We will assume the top tax rate of 53.53% on the salary, a 5% rate of return on any investible assets and withdrawals of $150,000 from age 35 to age 45 at a 40% tax rate.

By utilizing the RCA strategy and smoothing out the income, the Player ends up with $270,000 more in after-tax savings in this example. Contact GBL to learn about RCAs for NHL players.

Founded in 1995, GBL is a leading provider of retirement, health, and cross-border solutions for business owners across Canada. With offices in Calgary and Toronto, we have served 6,000+ clients, have 3,000+ Financial/Investment Advisors in our network, actively manage 2,000+ IPPs and RCAs, and have created 1,000+ HBPs and 3,000+ FMVs. We’re known for our industry leading client service and administration, as well as our top-notch actuarial group. Contact us today at [email protected] or 403.249.1820 and follow us to learn how we can help Build Your Future. www.gblinc.ca

[1] The RCA example has been simplified and is for illustration purposes only. An NHL player may be subject to tax in other Canadian and cross-border jurisdictions. A cross-border tax planning specialist should be consulted for the purpose of assessing a player’s overall tax liability.