Posted under: IPP

In years past, many business owners and incorporated professionals have been advised to shy away from Individual Pension Plans due to legislative requirements that were deemed overly burdensome and restrictive with regards to funding. Over the years, the legislative landscape has improved significantly, making Individual Pension Plans a more flexible and adoptable strategy for retirement and tax planning purposes.

Individual Pension Plans (IPPs) are pension plans established for businesses owners and professionals to save for their own retirement. This means the business owner or professional is the employer, providing the pension benefit, as well as the member receiving the pension benefit. Due to this, many provinces have acknowledged the uniqueness of IPPs and exempted them from part or all of their provincial legislation. All IPPs continue to be registered with CRA, however, provincial (including OSFI) pension legislation is written to protect members and enforce plan funding. With exemption from provincial pension legislation, this creates a much more flexible environment for IPPs. This provides all of the upside benefits in terms of tax deductions, without the downside of enforced funding when cash flow is lower in the lean years.

With provincial exemption, annual funding is not enforced (including any deficiency funding). Filing of reports and annual administration is also not required provincially, and delays for provincial approval in situations like the termination of the plan no longer applies.

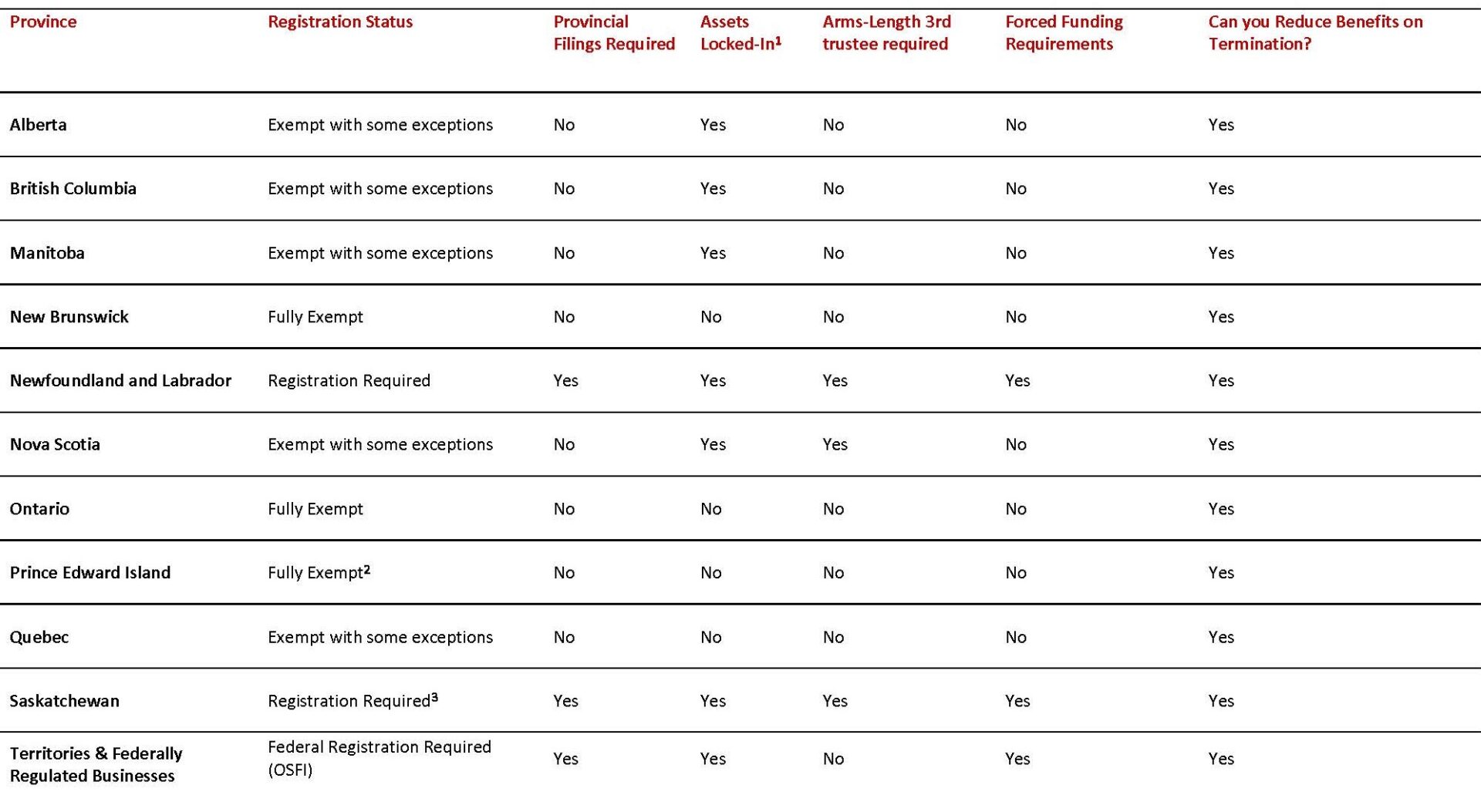

Note: the following exemption table applies to Connected Persons only (Owns 10% or more shares or is non-arm’s length to the person who does. See detailed definition below)

In the past few years, more provinces have exempted IPPs from their legislation. In many provinces, IPPs are exempt from filings and provincial oversight, but certain conditions, such as the locking in of pension funds still apply. In Ontario, IPPs are fully exempt from legislation, meaning even locking in of the IPP assets is not required. The table below outlines the current pension legislation landscape with respect to IPPs.

1 Locking-in provisions vary from province to province with unlocking provisions available under certain circumstances

2 Pension Legislation was never implemented in PEI

3 An IPP exemption has been discussed and may be released soon

Note: the above is current as of November 2024.

With this new landscape offering more flexibility with an IPP, it can be a great time to revisit this strategy for maximizing retirement savings. For more information on the IPP, please visit our website at www.gblinc.ca or reach out to us at info@gblinc.ca.