Posted under: News, Business Owners, IPP

The Good News: Despite tax increases and reduced savings strategies for the top 5% of Canadians, the 2016 personal tax season has ended in Canada…Finally.

The Bad News: Now at the end of May, you and your clients are likely feeling the corporate tax pinch.

The Ugly News: Tax policy for Business Owners and Professional Corporations has unfavourably changed

In a past GBL article titled The Taxman Cometh: Financial Strategy in an Increasingly Hostile Tax Environment, we discussed the recent adverse changes in Federal and Provincial tax policies across Canada, particularly toward Business Owners and Professional Corporations. These changes have forced Financial and Investment Advisors, Accountants, Tax Lawyers, and Business Owners, to become more strategic in managing their clients’ personal and business wealth in order to offer unique value to their clients while remaining competitive in an evolving financial planning realm (think “Robo‐Advisors”).

But tax policy is only one of many risks that are a business owner’s new reality. The risks of running a business in today’s market include, but are not limited to:

These risks have decreased certainty for business owners both now, and in retirement. To compound this, highest marginal personal and corporate taxes across Canada have increased, and tax savings strategies such as the multiplication of the Small Business Deduction (SBD) and lower tax rates through dividends have been diminished.

The combination of these factors does not bode well for a population that has severe retirement savings deficiencies. So how do we increase certainty at retirement? GBL offers a piece of the answer.

The Individual Pension Plan (IPP), considered the Cadillac of pension plans in Canada, offers the 2% Defined Benefit formula, the richest in Canada. In addition, three major benefits are offered to the business owner and their corporation through the IPP:

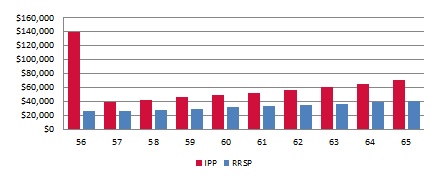

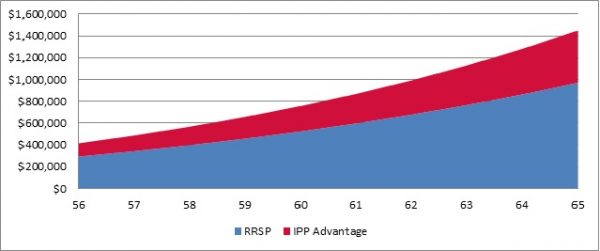

Each year, Canadians who receive T4 compensation can contribute up to 18% of their earnings toward Registered Savings Plans, such as the RRSP. In 2017, CRA’s maximum earnings dictates that a maximum of $26,010 can be contributed to an individual’s RRSP. This static 18% that can be contributed to an RRSP is contrasted by a dynamic, mostly increasing percentage based on age with an IPP. At age 40, a business owner can contribute a higher percentage of earnings into an IPP than they would be able to contribute to an RRSP; and one of the major appeals of the IPP is that this percentage will continue to increase from age 40‐65 when up to 61% more can be contributed to an IPP in 2017. The following table highlights the difference between IPP and RRSP Contributions and it shows a key benefit of the IPP at age 56 in the example: Tax deductible Past Service contributions of almost $100k:

The IPP not only allows the business owner to boost their retirement savings dramatically, but also allows them to move more money out of their corporation into a tax‐sheltered savings vehicle, thus decreasing corporate tax on retained earnings. It’s also a great way to transfer wealth out of the corporation prior to a sale or wind down.

As discussed earlier, Federal and Provincial tax policy has changed in many ways that are disadvantageous to the Business or Professional Corporation Owner. For high income earners, dividend tax has virtually been integrated with T4 tax, meaning that paying oneself dividends as opposed to T4 no longer offers a tax advantage. And with the elimination of the SBD multiplication, incorporated Professionals who are partners in a clinic or law firm for example, are losing options to shelter themselves from corporate tax. Fortunately, the IPP offers relief from these corporate tax pains, as every dollar deposited into the IPP is tax‐deductible to the corporation. This includes Current Service, Past Service, Investment Shortfall Top‐Ups, and Terminal Funding, which in a typical case, can allow a business owner to transfer hundreds of thousands of dollars out of their corporation to their retirement.

Today’s radically swinging political landscape, market performance, and tax policies present an unwelcome variety of challenges and risks for the Business and Professional Corporation Owner.

Fortunately, along with guided and committed savings, embedded within the IPP are risk mitigation mechanisms that guarantee safety for your money including:

Ideal Candidates for the IPP are Business or Professional Corporation owners typically age 40+, earning at least $100,000 T4 annually. Even better if you’ve maxed out your RRSPs, as an added benefit of the IPP is that it offers more contribution room than the RRSP, as mentioned above

The resurgence of the IPP can be attributed to a number of factors. Increased personal and corporate tax rates across Canada, higher investment, business, political, and other risks, and changes in tax policy for Businesses and Professional Corporations have tasked owners with a sense of urgency to think outside the box with their retirement savings. And for the Financial Advisor, more diversified competition has forced them to provide unique, tested, and reliable out‐of‐the‐box solutions for their clients. The IPP offers more flexibility than it once did, and is easier than ever to set up and manage with GBL’s tenured Client Service team guiding you along the way and administering your IPP so you can focus on growing your business.

The IPP can save the Financial Advisor and their client tax headache and provide retirement certainty while adding diversified value to the portfolio. If you or your client are business or professional corporation owners, age 40+, earning $100k+ T4 annually, then the IPP could offer significant value to you. Contact GBL now to learn more about the IPP.

*For Connected Persons in all provinces excluding SK, NL, NB, NS, and the Territories

Founded in 1995, GBL is a leading provider of retirement and health solutions for business owners across Canada. With offices in Calgary and Toronto, we have served 6,000+ clients, have 3,000+ Financial/Investment Advisors in our network, actively manage 2,000+ IPPs and RCAs, and have created 1,000+ HAWPS and 3,000+ FMVs. We’re known for our industry leading client service and administration, as well as our top notch actuarial group. And we don’t manage money, so we’ll work alongside your financial advisor but we won’t get in their way. We do the heavy lifting in getting your plan set up and managing it so your advisor can focus on growing your assets. Contact us today at info@gblinc.ca or 403.249.1820 and follow us to learn how we can help Build Your Future. www.gblinc.ca