Posted under: Business Owners, IPP

“What kind of parallel universe are we living in?” is a question we’ve asked ourselves and our clients over the past 21 months given that actuaries seem to have become the people in the room whom everybody wants to talk to. Actuaries are a cool group, don’t get me wrong, but the attention GBL has gotten since July 2017 has been incredulous, to say the least.

But it has been for good reason. Since 2016, Canada’s Federal and Provincial governments have done the following:

The province in which you reside will determine how much your personal tax rate has increased, and the number of businesses or business partners you have will determine whether your SBD will be clawed back or not. The new passive income and TOSI rules on the other hand, apply to all business owners and have sent business and professional corporation owners, their advisors, and accountants scrambling to find solutions to prevent significantly higher taxes from hitting their income statements each year.

The new TOSI rules make it more difficult to split income with family members. In an attempt to keep this article concise, that’s as specific as we’ll get on this component of tax changes. Where we will go into detail is on the new passive income rules.

Through the new passive income rules for Canadian-Controlled Private Corporations (CCPCs), decisionmakers in the Federal Government have determined that if your business generates over $50,000 in passive income annually, you have too much money in your corporation and should have your SBD clawed back by $5 for every $1 you exceed the $50,000 threshold. An example of how a company might surpass this threshold would be:

$1 million in invested assets x 5% return = $50,000

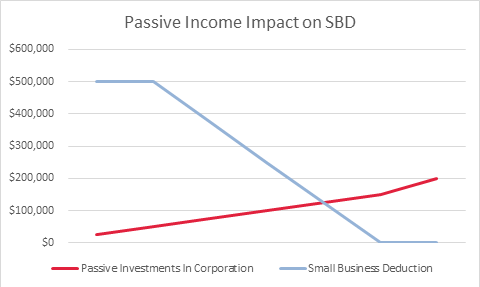

The following chart illustrates what the new passive income rules could look like for CCPCs:

Assuming that your corporation produces $500,000 of active business income and has over $150,000 in passive income (which would wipe out the SBD), depending on your province, your corporation could pay up to an additional $80,000 in tax for the year. As expected, this hasn’t gone over well with business owners and tax experts, especially considering the risks that the Canadian economy has been subject to, including:

The combination of these factors does not bode well for a population that has severe retirement savings deficiencies. What can be done to prevent this high increase in corporate tax and protect business owners from the increased risks of operating their businesses? Experts agree that one of the few last options in which business owners have available to protect themselves from these increased taxes and risks is the Individual Pension Plan.

The Individual Pension Plan (IPP), considered to be a supercharged RRSP, offers the 2% Defined Benefit formula, the richest in Canada. In addition, three major benefits are offered to the business owner and their corporation through the IPP:

Boost Retirement Savings Drastically

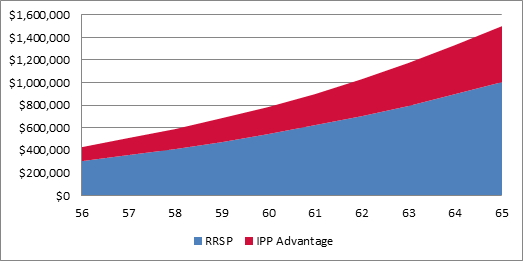

Each year, Canadians who receive T4 compensation can contribute up to 18% of their earnings toward Registered Savings Plans, such as the RRSP. In 2019, CRA’s maximum earnings dictates that a maximum of $26,500 can be contributed to an individual’s RRSP. This static 18% that can be contributed to an RRSP is contrasted by a dynamic, mostly increasing percentage based on age with an IPP. At age 40, a business owner can contribute a higher percentage of earnings into an IPP than they would be able to contribute to an RRSP; and one of the major appeals of the IPP is that this percentage will continue to increase from age 40‐65, when up to 65% more can be contributed to an IPP. The following table highlights the difference between IPP and RRSP total savings comparison and it shows a key benefit of the IPP:

IPP vs RRSP: A 2019 Savings Comparison

Decrease Corporate Tax

Federal and Provincial tax policy has changed in many ways that are disadvantageous to CCPCs. For high income earners, dividend tax has virtually been integrated with T4 tax, meaning that in many cases paying oneself dividends as opposed to T4 no longer offers a tax advantage. Fortunately, the IPP offers relief from these corporate tax pains, as every dollar deposited into the IPP is tax‐deductible expense to the corporation, which is particularly important given the recent tax changes on passive income. This includes Current Service, Past Service, Investment Shortfall Top‐Ups, and Terminal Funding, which in a typical case, can allow a business owner to transfer hundreds of thousands of tax deductible dollars out of their corporation to their retirement fund. In addition to these deductions, investment/financial advisor fees can also be deducted so long as the assets are held in a fee-based account.

Mitigate Risk

Today’s radically swinging political landscape, market performance, and tax policies present an unwelcome variety of challenges and risks for the Business and Professional Corporation Owner.

Fortunately, along with guided and committed savings, embedded within the IPP are risk mitigation mechanisms that guarantee safety for your money including:

The IPP in a Nutshell:

Experts agree that during this period in which CCPC owners fear the impacts of a multitude of unfavourable tax changes, the IPP is one of the most effective last lines of defense. Ideal Candidates for the IPP are Business or Professional Corporation owners typically age 40+, earning at least $100,000 T4 annually.

*Funding and top-ups not enforced for Connected Persons in all provinces excluding SK, NL, NB, NS, and the Territories

By Ryan Ackers, Vice President, Business Development & Client Relations, GBL

Founded in 1995, GBL is a leading provider of retirement and health solutions for business owners across Canada. For more information on our services and strategies contact: info@gblinc.ca or 403.249.1820 and follow us to learn how we can help Build Your Future.