Posted under: Business Owners, IPP, RCA, FMV

As we have officially moved on from what is widely considered to be the most tumultuous and disruptive year of our generation, many advisors are cautiously optimistic as we navigate through 2021. Though the COVID-19 vaccine rollout gives much hope for this year, there are many who worry about changes in tax policy in order to pay for the expensive, but necessary COVID-19 Economic Response Plan. At GBL, we have heard[1] that all options are on the table, including, but not limited to:

The fore mentioned options are worrisome considering that since 2016, we have seen:

Business owners, incorporated professionals, corporate executives and employees, professional athletes, and their advisors and accountants are looking to advanced planning strategies and products to protect their wealth from market, tax, and creditor risk; and unfortunately, there are not many opportunities that remain. Two remaining opportunities, which are offered by GBL, are the Individual Pension Plan (IPP) and Retirement Compensation Arrangement (RCA).

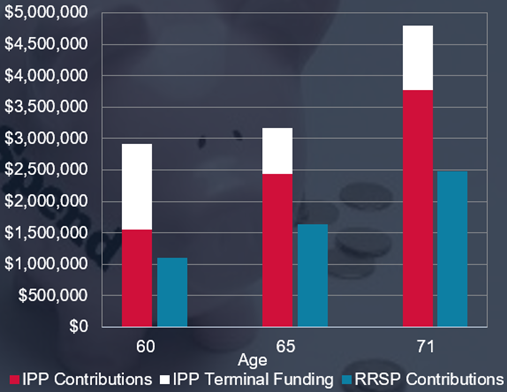

The IPP is viewed as a supercharged RRSP for business owners and incorporated professionals. It is a viable strategy for those who fall between the ages of 38-71 and earn T4 income. The benefits of the IPP are fourfold:

The RCA is viewed as a supercharged IPP and is used by business owners and incorporated professionals who are looking to provide themselves with an enhanced retirement benefit. It also allows them to pull money out of their corporation and like an IPP, defer paying personal taxes on the money until the money is withdrawn. It is also popular for corporate executives and employees as both a golden handcuff and a severance package tool. Finally, the RCA is a popular tool for professional athletes such as NHL players.

The key advantage of the RCA is the ability for one to deposit sums of money into it with no mandatory withdrawals. This differs from an RRSP or an IPP as both require the commencement of withdrawals at age 71, and once withdrawals begin, they cannot be stopped (with the exception of RRSP withdrawals prior to age 71). The RCA allows for flexible funding and withdrawals.

Many view the downside of the RCA to be the Refundable Tax Account (RTA), a security deposit of 50% of the RCA assets that is held in a non-interest-bearing account. When money is deposited into or grows within the RCA, 50% of the assets deposited or grown must transfer into the RTA, while conversely, when money is withdrawn or assets decline in the RCA, the RTA must replenish the RCA’s investment account so that both the investment account and RTA are equal. The RTA has long been considered the downside of the RCA, however even taking into account that the half of the assets that sit within the RTA do not grow interest, typical RCA tax savings range from 20%-45%, making it prudent for an advisor to consider the RCA regardless of the restrictions of the RTA. Now is the time to look past the RTA and consider the benefits of the RCA.

Take, for example, an executive severance case in Alberta where two executives who are currently in the highest income bracket receive a $375,000 lump sum severance each:

Executive A: Does not like the idea of the RTA and decides to forego the RCA

Executive B: Decides to deposit their severance into an RCA

It is abundantly clear that in this common scenario, that the benefits of the RCA far outweigh the downsides of the RTA.

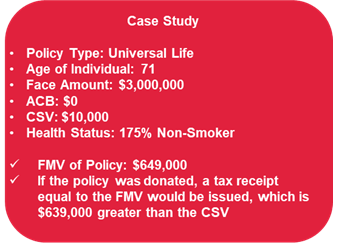

An FMV determines the fair market value of a corporately owned life insurance policy. FMVs are commonly used in two cases:

The FMV is necessary in some cases, while in others, it can provide significant tax benefits.

By Ryan Ackers, Vice President, Business Development & Client Relations, GBL Inc.

Founded in 1995, GBL is a leading provider of retirement and health solutions for business owners across Canada. For more information on our services and strategies contact: [email protected] or 403.249.1820 and follow us to learn how we can help Build Your Future.