Posted under: News, Business Owners, IPP

The perpetual arms race between increasing and decreasing taxes in Canada, alongside the use of strategies that help taxpayers pay less of their hard earned dollars to government coffers date back to the birth of our great country. Keeping said arms race flourishing are changing governments and tax policies.

Imagine this: You’re a business owner, a doctor let’s say, who pays yourself an income at or above the highest marginal tax rate annually. Federal tax rates at the top have increased since the new government took power, and depending on which province you reside, your provincial tax rates may have increased as well (Congratulations if you reside in British Columbia. You arguably have Canada’s best view AND you’re paying the lowest marginal tax rates). The new reality is that if you earn $300,000+ per year, you’re a member of Canada’s top 1%. If you earn over $150,000 per year, you’re part of the top 5%. Guess who the government is targeting with their tax policy to fill their coffers?

If we look at Alberta, the highest marginal tax rate for business owners paying themselves $300,000 in T4 annually has jumped from the 39% that Albertans have grown accustomed, to 48%.

That’s a 9% increase on your tax bill for T4 earnings over $300,000

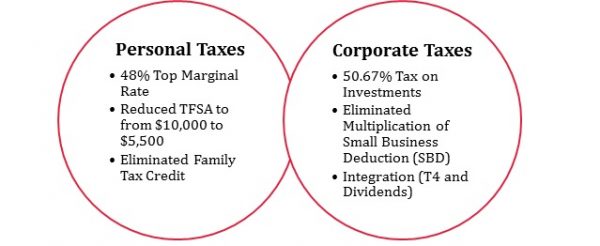

If you earn $400,000 T4 annually, you’ll pay a sizeable $159,000 in average income tax. To compound your conundrum, the following changes in tax policy also target top 5% earners:

Most of these unfavourable changes to the top 5% were implemented in a short timeframe, just over one year. If you feel backed into a corner, you’re probably onto something; and you’re not alone. As the saying goes: The Taxman Cometh. When your government wants your money, it shall obtain it. Schadenfreude!

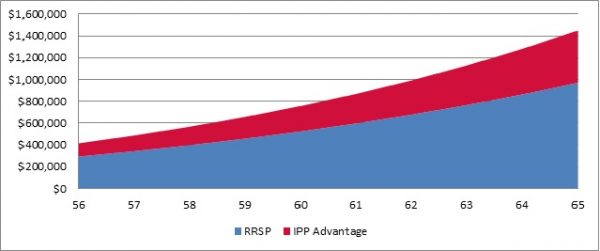

What I can do? Registered Savings Vehicles, such as the Registered Retirement Savings Plan (RRSP) and the Individual Pension Plan (IPP) have remained an integral part of a tax savings strategy and an effective way to save for retirement. But for most high income earners, conventional savings vehicles such as the RRSP don’t provide enough benefit to reduce enough tax and maintain their lifestyle in retirement. So what are your options as a high income business owner? An IPP is among the best options available to you today, as it provides up to 61% more annual contribution room than an RRSP.

What is an IPP? Considered the “Cadillac” of pension plans in Canada, the IPP offers a 2% defined benefit, our highest pension formula, and the same plan that your friend who works for the government* brags about at your barbecues. The IPP makes sense for business owners typically age 40+ who earn $100,000+ annually. It is an excellent means to reduce corporate tax while significantly boosting retirement assets. Major benefits of the IPP include:

IPP vs. RRSP: A Savings Comparison

Assumptions: $145,722 T4 (2017 Max Earnings) – 55 year old incorporated for 10 years – $250k in RRSPs

These benefits are great and all, but let’s get to the real value add: You’ll have the one up on your friend at the barbecue because you’ll get the same pension as they do, without having to work for the government!*

Do these trends and solutions impact me?

The good news is you don’t have to walk the path alone; we’re here to help.

*Only used to highlight differences in pension plans across public and private sectors.

Founded in 1995, GBL is a leading provider of retirement and health solutions for business owners across Canada. With offices in Calgary and Toronto, we have served 6,000+ clients, have 3,000+ Financial/Investment Advisors in our network, actively manage 2,000+ IPPs and RCAs, and have created 1,000+ HAWPS and 3,000+ FMVs. We’re known for our industry leading client service and administration, as well as our top notch actuarial group. And we don’t manage money, so we’ll work alongside your financial advisor but we won’t get in their way. We do the heavy lifting in getting your plan set up and managing it so your advisor can focus on growing your assets. Contact us today at [email protected] or 403.249.1820 and follow us to learn how we can help Build Your Future.

Author: Ryan Ackers – Vice President, Business Development & Client Relations – GBL Inc.

Contributors: Brian Cabral, Navaz Cassam, Laura LaRiviere, Fraser Lang, Tatenda Mawoyo – GBL Inc.

Date: February 16, 2017