Posted under: Business Owners, RCA

For majority of business owners, the sale of their business represents a bulk of their retirement savings. Years of hard work, sacrifices, and sweat equity has led to the moment of sale with a big pot of gold.

The sale of the business is not always a share sale, and in the case of a share sale, there needs to be careful planning in order to preserve the lifetime capital gains exemption (LCGE).

The LCGE is a cumulative exemption that allows for up to $866,912 (as of 2019) of the realized capital gain on selling the shares of one’s qualified Canadian corporation to be considered tax free. A disposition above this limit is treated as a capital gain and tax is only paid on 50% of that gain. The one caveat of the LCGE is that in order for the company to be eligible, 90% or more of the company’s assets must be used for active business purposes. This is known as the 90/10 rule.

Based on a combination of the LCGE and the capital gains treatment it seems obvious to the seller that the sale should be a disposition of the shares, but for the share purchaser, they are not only buying all the positives of the business, but also any liability or risk from past actions of the company. For this reason, we often see the buyer suggesting an asset sale at perhaps a larger dollar amount, or a hybrid of the two.

In an asset sale, the shares in the business are not purchased and as a result the sale is not eligible for the LCGE. The proceeds of the asset sale are received by the seller’s corporation and are considered active taxable income to the corporation.

Whether the transaction is an asset or a share sale, careful planning should be taken to maximize tax efficiency and to avoid any unintended consequences. One of the least discussed planning tools, but one that can be of great use, is a Retirement Compensation Arrangement (RCA). The RCA is a retirement plan established by the corporation that can be funded on a one time or periodic basis, for a company to contribute to the member’s retirement on a deductible basis. The RCA can be customized to fit the needs of both the company and the member.

Contributions to an RCA are based on a pension benefit calculation and are deductible to the company as an expense while not being a taxable benefit to the employee. Depending on the employee’s age, years of employment and best 3-year average earnings, there can often be significant contribution room available. In the case of a sale of a business, this significant funding opportunity can be deployed on an as-needed basis. The application of the RCA in either a share or asset sale may be for different purposes, but both are very compelling.

Utilizing an RCA in a Share Sale:

With a share sale, it is crucial to ensure the corporation is eligible for the LCGE. An abundance of passive income can put the company offside and as a result negate the biggest feature of a share sale. Some measures such as use of the capital dividend account (CDA) or paying back shareholder loans may be used to extract these passive assets, but another effective method is the use of the RCA.

Let us take the example of George and Gwen, a 55 year old couple who have operated their successful business over the last 20 years. Both have earned $100,000 per year in T4. They are looking to sell the shares of the company for $15 million. The company uses $12 million for operating purposes but has $3 million in passive assets. After using the $500,000 available in their CDA they are still $1 million over the limit of the 90/10 rule.

Based on their past earnings, the RCA is able to absorb the full $1 million that is over the 90/10 rule and extract the excess capital from the corporation. With the RCA, George and Gwen can now decide to draw out the money as they see fit. Assuming they have ample assets to live off from the share sale, they could look at drawing $50,000 each over a 10 year period of time once any taxable events from the sale are behind them. In Ontario, the $50,000 would attract an average tax rate of 16.12%. Assuming there is no investment growth in the RCA, George and Gwen would net $838,800 after-tax and in addition, they both now can use their $866,912 of the LCGE on the disposition of the shares.

Using an RCA in an Asset Sale:

When looking at asset sale, care must be taken following the sale to offset the proceeds of the sale received by the seller. For Canadian small businesses, any active income below $500,000 is taxed at a much lower tax rate than income that is over $500,000. For an Ontario business in 2019, the small business rate would be 12.5% while the rate for active income above $500,000 is 26.5%. The combined tax rate between the higher corporate rate and the highest dividend tax rate is 55.42%. This is approximately 2% higher than the top marginal tax rate. With the asset sale, the proceeds are received by the seller’s corporation as active income and any amounts retained after the corporate year end over $500,000 would be subject to that higher corporate tax rate and eventually the 55.42% overall tax once the dividend is paid out.

There are options to offset the active income above $500,000.

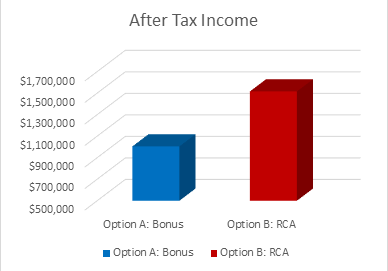

Take the example of John and Emily, a 60 year old married couple who own a grocery store in Ottawa, Ontario. They have operated the store for 20 years and have each drawn incomes of $100,000 per year. They have an offer to sell the assets of their business to a large grocery chain and the net amount payable to the company is $2.5 million. In this example, $500,000 can be retained at the lower 12.5% corporate rate, but $2 million would be exposed to the higher rate. A comparison between the bonus out and the RCA strategy yields far different outcomes.

In order to compare the two, let us assume that John and Emily would have the ability between ages 61-71 to defer other income and draw a pre-tax income of $100,000 per year each from an RCA.

Option A: Bonus the $2 million between Gus and Emily

Option B: The RCA

By using the RCA and forward averaging the tax brackets over a 10 year time period, John and Emily are able to save $255,382 in personal tax and their company saves $39,000 in Employer Health.

As the Business Owner you invest your time, effort, and money into your business. With all of the care that has gone into growing your business, it is crucial to explore the different options to safeguard the fruits of your labour when it comes time to sell your business. We can be reached at [email protected] with any questions you may have.

By Fraser Lang CLU, CFP, CHS, Senior Vice President, GBL Inc.

Founded in 1995, GBL is a leading provider of retirement and health solutions for business owners across Canada. For more information on our services and strategies contact: [email protected] or 403.249.1820 and follow us to learn how we can help Build Your Future.