An Individual Pension Plan (IPP) is a defined benefit pension plan designed for business owners of incorporated companies. An IPP allows a business owner to increase their retirement savings and establish long-term financial security through considerable tax-deductible contributions.

An IPP is well suited for:

*An IPP can be established for someone with lower earnings

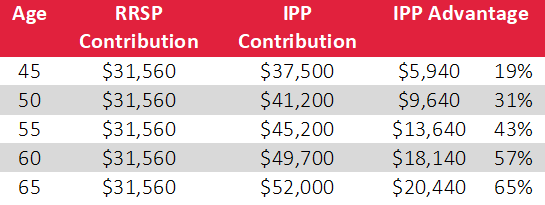

An IPP is similar to an RRSP in that it uses an investment account to accumulate assets over time as retirement benefits. However, unlike the RRSP, an IPP allows for the accumulation of greater assets – up to 65% more than an RRSP – and like a traditional pension plan, sets your monthly income at retirement. An IPP also provides certain additional guarantees beyond an RRSP to further protect your financial future (assets accumulated within an IPP are locked-in and may be used only for retirement purposes).

Reviewing the IPP forms and documents received from you was wonderful, everything was so well organized and prepared with so much diligence and I really appreciate that!

Supervisor, Administration Support

Raymond James Financial

Complete our online IPP Questionnaire or download the PDF. Your GBL representative will prepare a custom IPP quote at no cost within 1-2 business days.

Upon receipt of your IPP quote, please contact your GBL representative who is available for consultation to answer any questions that may arise.

Once the decision has been made to set up an IPP, you will receive our IPP registration package. Forms can be completed and returned by mail, email, or fax to your GBL representative. Please allow 5-10 business days to receive your IPP documentation for signing.

Your GBL representative is available to assist in the signing process and to answer any last minute questions. Upon final execution of the IPP agreements, GBL will register the plan with Canada Revenue Agency (CRA) and the provincial authority (if applicable).

Upon CRA approval, the IPP account can be opened and the plan can be funded. At this time you will identify investment objectives to ensure assets are invested according to your preferences and CRA funding regulations.

IPP contributions are determined by a series of actuarial valuation reports in order to ensure the plan has sufficient assets at the time of retirement. Annual income at retirement age is calculated using:

Contributions are graduated by age, so the older the member, the more their company can contribute. IPP contributions first exceed RRSP contributions around age 40. The annual contributions compounded at a 7.5% net annual rate of return will ensure your client’s plan has adequate assets to provide for their retirement benefits.

Once the member retires, they have a choice of retirement vehicles. These include a monthly pension from the plan, an annuity, a Life Income Fund (LIF), or a Locked-In Retirement Income Fund (LRIF).

If an annuity is chosen, you would obtain a market comparison and choose the insurer. The plan will then transfer funds from the IPP to the life insurance company to purchase the annuity. Annuities can be either single life, covering the life of the plan member only or, if married at date of retirement, a joint & survivor (J&S), with payments that may reduce on the death of the member. The J&S option usually includes a minimum guaranteed period of 5 years and subsequent payments to the surviving spouse in full or reduced by a percentage selected at the time of retirement.

"*" indicates required fields